My attention was drawn to this post by blogger and columnist Johann Hari. As a general rule, Johann Hari tends to divide people into two camps: those who hang on his every word and those who see through him, and as I’m in the latter group I don’t usually waste much time reading his stuff. But I read this, because a friend recommended it, and, having done so, I feel almost duty bound to point out why he’s wrong. And, since he doesn’t allow comments on his own blog (I wonder why not?), I have to do it here instead.

Hari’s basic argument in this article is that there’s nothing wrong with the current level of national debt, because historically it’s almost always been higher. As he says,

Let’s start with a fact that should be on billboards across the land. As a proportion of GDP, Britain’s national debt has been higher than it is now for 200 of the past 250 years. Read that sentence again. Check it on any graph by any historian. Since 1750, there have only been two brief 30-year periods when our debt has been lower than it is now. If we are “bust” today, as George Osborne has claimed, then we have almost always been bust.

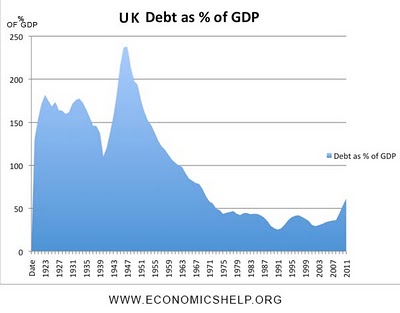

As it happens, he is actually right about that. If you take the national debt in the context of the last couple of centuries, it is low by comparison. I don’t have stats which go quite that far back, but here’s a nice graph from economicshelp.org which goes back to the 1920s:

To be sure, if you look at that then our current debt is trivial by comparison with the years either side of WWII. So, does that mean that our current level of debt isn’t a problem?

To be sure, if you look at that then our current debt is trivial by comparison with the years either side of WWII. So, does that mean that our current level of debt isn’t a problem?

Well, no, and I think most people can easily see why. For a start, the huge levels of debt from the 1930s through to the immediate post-war period were caused by the global depression and war itself. More importantly, government spending on things like welfare, health, education, etc was much lower in that era. And I think that we, from our comfortable 21st century perspective, often don’t realise how much better our standard of living is now than it was then.

I was thinking about that a couple of days ago, in fact. My daughter’s nursery were doing a trip to the butterfly farm in Stratford, and as part of that all the children were asked to take a picnic. It prompted me to ponder on how, when I was a child, if we went anywhere as a family day out, we’d take a picnic because we simply couldn’t afford to pay for food while we were there. These days, we very rarely do that – I think the only occasions when we have are when we’re not expecting there to be any food available, or because the picnic itself is part of the experience, rather than because we can’t afford it. Even when I was earning less than the average salary, I don’t think that the cost of eating out would have prompted us to take a picnic. It’s a huge change from when I was a child in the 60s and 70s.

Johann Hari, of course, isn’t old enough to remember that. His personal memories only go back as far as the 80s, so he’s never experienced a time when the UK could genuinely be described as poor. I’m only just about old enough to remember the tail end of it, but those from a generation before me will easily be able to recall the grinding hardships of austerity Britain in the immediate postwar period. But that doesn’t excuse Hari’s simple lack of research – there are plenty of websites and books which will dispel his illusion that living in a high-debt economy is perfectly OK.

The reality which Hari fails to acknowledge, or possibly isn’t even aware of, is that debt isn’t an abstract issue. The level of national debt correlates very strongly with standards of living – the higher the debt, the lower the average standard of living. It also correlates – and, again, inversely – with government spending on things like welfare and education. You could take the graph above and turn it upside down, and the line from the end of WWII until the 80s would indicate the increase in spending on the NHS, pensions, unemployment benefit and schools.

So, yes, we could live with a much higher level of debt if we’re prepared to accept a worse health service, a poorer education system and a lower standard of living overall. I don’t want that. I strongly suspect that Johann Hari doesn’t, either. But, unlike him, I’m aware that we can’t have it both ways. If we want to maintain our current standard of living in the long term, we have to get the debt down in the short term. And that’s why Johann Hari is wrong.