There’s a meme currently doing the rounds of Facebook and Twitter, purporting to show that benefit fraud is pretty much too trivial to care about. Here’s the infographic:

It’s pretty obvious what we’re intended to perceive here. Big blue circle on the left, little pink circle on the right, isn’t it obvious that the small one isn’t worth bothering with?

Well, no. There are quite a lot of things wrong with this comparison. Let’s look at a few.

The most obvious is that the big blue circle is the unofficial total of lost tax revenue. It’s there because the official total, in the red circle, isn’t anywhere near as scary (although it’s still bigger than the pink circle). But, on the right, we only have the official figures. The infographic omits it, but there are other, equally unofficial (but equally well-founded) estimates of the value of benefit fraud which greatly exceed the official figures.

To make a meaningful comparison, therefore, we need to disregard the big blue circle on the left and only use the red circle. Anything else is simply not comparing like with like. If we’re sticking with official figures on one side, then we need to stick with official figures on the other, and ignore all the various unofficial estimates.

OK, but the red circle is still a lot bigger than the pink one. But look at what it contains: Tax evasion, tax avoidance and tax uncollected. Those are three very different things. By contrast, the right hand side breaks down excess expenditure into two different circles: overpayment by error and fraud. (We’ll ignore the green circle, as it’s not really relevant to the comparison, save to say that benefits unclaimed are a good thing – it means people are taking responsibility for their own lives rather than expecting the state to provide).

So our comparison still isn’t meaningful. We have multiple categories included in the red circle (£30 billion) and only one in the pink circle (£1.2 billion). We need to find out what part of the red circle is the equivalent of the pink one.

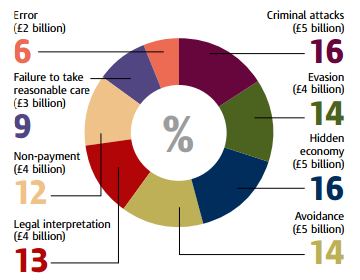

Fortunately, HMRC does actually publish this information. Here’s a pie chart from that PDF:

The document goes on to explain what those different categories mean. You can read the original by following the link, but here’s a brief summary:

Error. This is tax lost due to cock-ups by HMRC. We can ignore this when comparing with benefit fraud, since error is a separate category (the small pale blue circle) on the right.

Failure to take reasonable care. This is the counterpart of error, in this case cock-ups by taxpayers getting their submissions wrong. It is, however, innocent error, caused by carelessness or ignorance rather than malevolence, so it’s still not analogous to benefit fraud. (In this context, too, it should be borne in mind that commercial taxes, such as VAT and Corporation Tax, can be horrendously complex and difficult to calculate accurately, even for professionals).

Non-Payment. This is tax that would have been paid, but wasn’t. Mostly, this is due to companies going bankrupt and not being able to afford to pay their taxes. Again, while regrettable, this is not fraud.

Legal Interpretation. This is a lovely little weasel phrase, used by HMRC to describe a situation where their lawyers and accountants and the taxpayer’s lawyers and accountants disagree on how much should be paid, and the taxpayer wins the argument. Depending on which side you’re on, this may or may not be considered immoral, but it still isn’t illegal.

Avoidance. This is people taking advantage of legal loopholes to minimise their tax liability. As before, there are various opinions as to the morality of this, but its legality is not an issue. So, still not equivalent to benefit fraud.

Criminal Attack. This is tax lost as a result of deliberate criminal activity such as smuggling and VAT fraud. This is clearly illegal.

Evasion. This is tax lost due to deliberate falsification of information supplied to HMRC – lying on a tax return, for example, or hiding money in a Swiss bank account. This, too, is definitely illegal.

Hidden Economy. This is generally undeclared income, such as earnings from “cash in hand” work and moonlighting. This is illegal too, although it’s interesting that HMRC doesn’t consider it to be in the same category as evasion. (To be slightly more precise, HMRC considers that evasion is an act of commission, telling a deliberate lie, whereas the hidden economy is an act of omission, simply keeping quiet and hoping you don’t get asked).

These last three are the only ones that can reasonably be considered equivalent to benefit fraud, not least because they are the only ones which – like benefit fraud – are actually illegal. Even within those, though, they are not the same. Criminal attacks on the tax system are obviously a serious concern, but they have no real equivalent in benefit fraud (and some might argue that the government is the author of its own misfortune in many cases, as high excise rates are precisely one of the things which encourage smuggling and counterfeiting).

The hidden economy, on the other hand, despite being illegal, is something that a lot of people would either not care much about or even tacitly support. Realistically, anyone who has ever paid cash in hand for work done by a tradesman has probably contributed to the hidden economy; many people who buy and sell on eBay or at car boot sales have engaged in it directly. And, of course, many of the people who work in the hidden economy are also those who are likely to be over-claiming benefits, and for the same reason – they are short of money. If we are being invited to withdraw our condemnation of benefit fraudsters, therefore (which is, after all, the point of the infographic meme), then, to be even-handed, we also have to be equally tolerant of those who don’t declare their earnings for the same reasons. I’ll come back to this point later.

That leaves outright tax evasion, therefore, as the only part of this £30 billion tax shortfall which is both equivalent to benefit fraud and indisputably deserving of condemnation. So where does that leave us, in financial terms?

The answer, according to HMRC, is that tax evasion accounts for approximately £4 billion of lost revenue. That’s still more than benefit fraud, of course (just over three times as much, in fact), so it is a much worse loss.

But it isn’t several orders of magnitude bigger, as the infographic misleadingly implies. If £4 billion is worth caring about (and it is), then £1.2 billion, though lesser, is worth caring about too.

In any case, the other implication of the meme, that the government cares more about benefit fraud than it does about tax losses, is completely and utterly false. HMRC spends a lot of time end effort tracking down evaders and tax frauds, and the police put just as much effort into hunting down criminal gangs that scam the state. The idea that the government is blithely unconcerned about various tax crimes, while clamping down hard on people who over-claim a few quid on benefits, is purely an invention of those who seek to discredit those in power. If anyone really thinks that the Chancellor of the Exchequer would prefer to miss out on £30 billion of tax revenue than take any action to recover it, then they’re just plain daft.

Going back to the comments about the hidden economy, though, I do actually have quite a lot of sympathy both with those who over-claim benefits or who under-declare income. And that’s because the tax and benefit systems often seem designed to cause the greatest pain to those who play by the rules. Benefit traps are a classic example – it’s possible for someone to take a job, but be worse off as a result when their benefits are abruptly withdrawn. And income tax often hits low to middle income earners the hardest, as they have lower disposable incomes with which to pay over-inflated housing, fuel and transport costs (all artificially high due to government manipulation) and little in the way of mitigation from benefits. So it isn’t surprising that someone who has just got a job will “forget” to mention that fact when collecting housing benefit, or that someone who can get paid in cash will just pocket the money rather than log it in their accounts. I don’t approve of all forms of benefit fraud or hidden economic activity, but I do find it hard to disapprove of that which is clearly encouraged by the system.

So what’s the solution to the real problem of benefit fraud, the problem that the infographic tries to pretend is insignificant? I think it’s the same as the solution to the problem of most tax avoidance and the hidden economy. We need a simpler, more transparent and easily understood tax and benefit system which never penalises someone for working harder or earning more. But I suspect that isn’t going to appeal to whoever created the infographic.

Update: The Methodist Church has got in on the misleading infographic act too, with one which avoids the error of comparing official with unofficial figures but otherwise makes exactly the same errors as this one. Sigh.